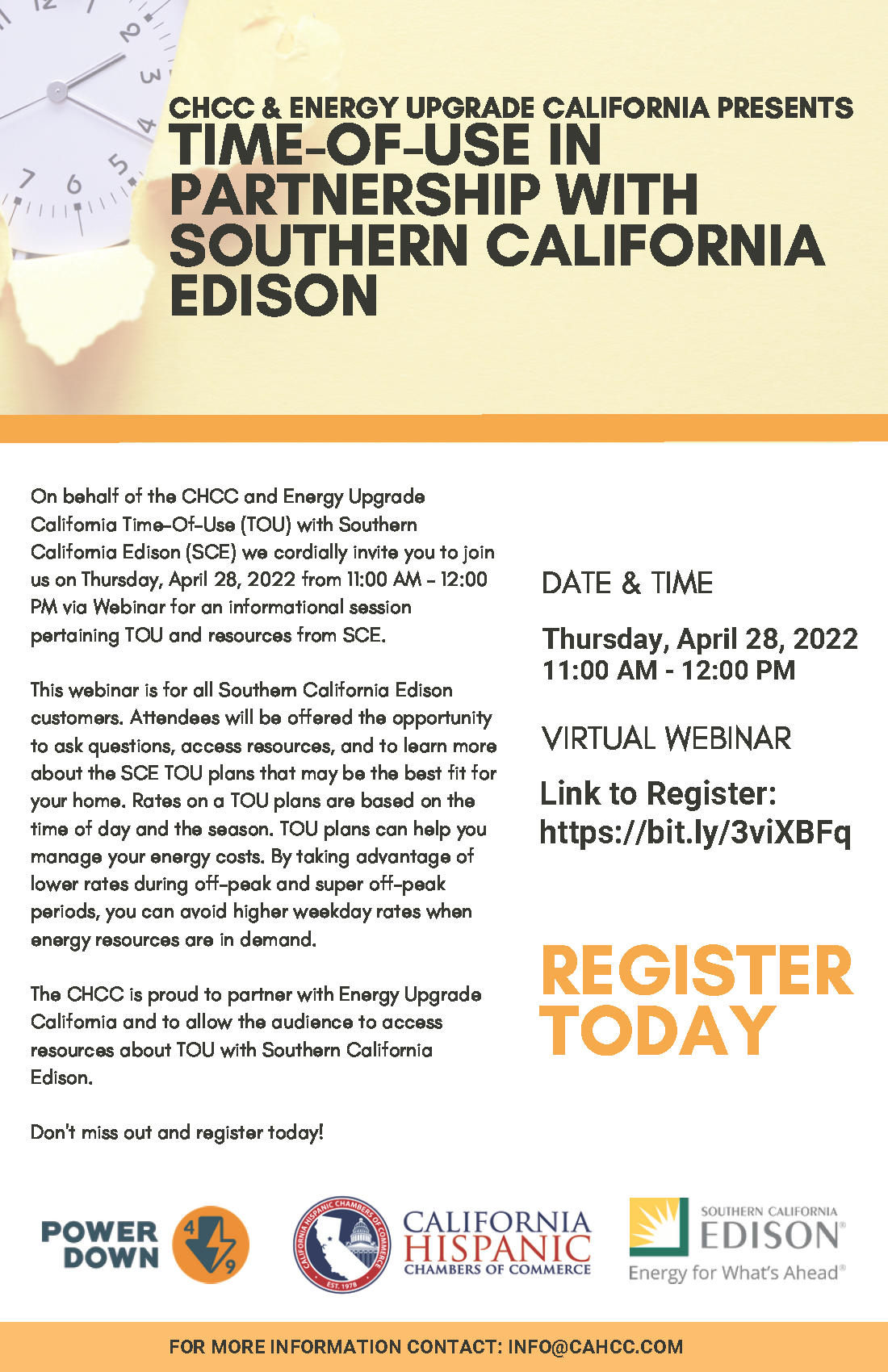

On behalf of the CHCC and Energy Upgrade California Time-Of-Use (TOU) with Southern California Edison (SCE) we cordially invite you to join us on Thursday, April 28, 2022 from 11:00 AM - 12:00 PM via Webinar for an informational session pertaining TOU and resources from SCE.

I encourage you to share with your leadership and members for resources to better understand TOU and cost-savings for diverse small businesses, families, and residents.

To register for the event please click this link: https://bit.ly/3viXBFq

This webinar is for all Southern California Edison customers. Attendees will be offered the opportunity to ask questions, access resources, and to learn more about the SCE TOU plans that may be the best fit for your home. Rates on a TOU plans are based on the time of day and the season. TOU plans can help you manage your energy costs. By taking advantage of lower rates during off-peak and super off-peak periods, you can avoid higher weekday rates when energy resources are in demand.

The AVHCC and CHCC is proud to partner with Energy Upgrade California and to allow the audience to access resources about "Time-Of-Use" with Southern California Edison. Don't miss out and register today: https://bit.ly/3viXBFq